#SINGLE 2022 TAX BRACKETS HOW TO#

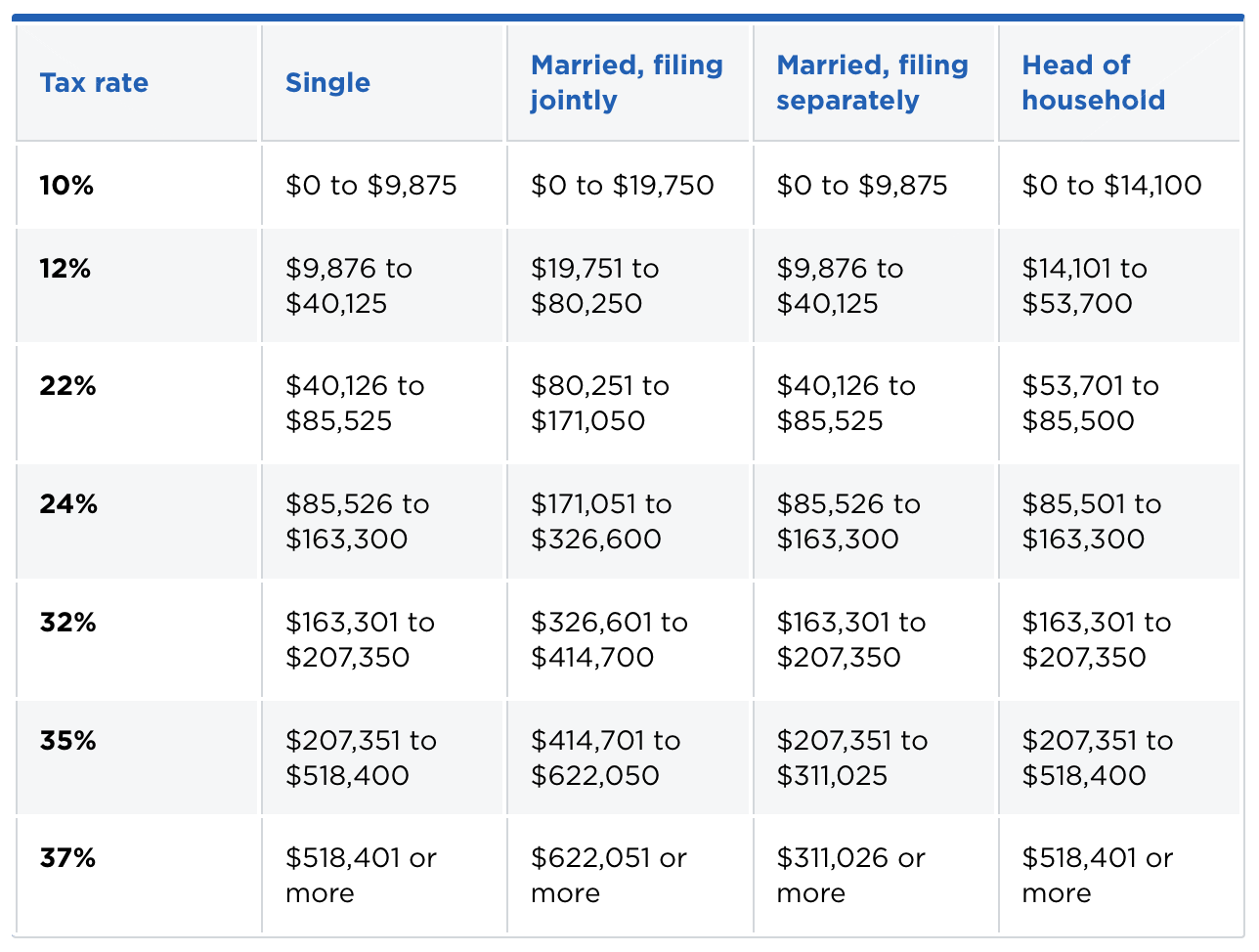

How To Calculate Your Federal Income Tax Bracket Here are some reasons why you should file. You may be entitled to money from the IRS even if you have little to no income. Trending Story: File A Tax Return This Year, Even If You Usually Don’t Do It Some of that will be taxed in lower brackets. For example, if you’re single and your 2022 taxable income was $50,000, not all of that will be taxed at 22%, the top bracket for a single person making $50,000. If your taxable income increases, the taxes you pay will increase.īut figuring out your tax obligation isn’t as easy as comparing your salary to the brackets shown above. The amount you pay in taxes is dependent on your income. The brackets help determine how much money you need to pay the IRS annually. Tax brackets were created by the IRS to implement America’s “progressive” tax system, which taxes higher levels of income at the progressively higher rates we mentioned earlier. 2023 Married Filing Jointly Tax Brackets If taxable income is: Get the latest news and updates from the Minnesota Department of Revenue by following the department on Facebook and Twitter or by signing up for our email subscription list. Head of Household standard deduction - $20,800įind more information on standard deductions, including standard deductions for those who are blind or are 65 and over, on the department’s website.Married Filing Separate standard deduction - $13,825.Married Filing Joint standard deduction - $27,650.Ģ023 Standard Deduction and Dependent Exemption Amountsįor those taking the standard deduction or the dependent exemption at the state level, Minnesota has calculated those amounts for 2023 as follows:

#SINGLE 2022 TAX BRACKETS FULL#

You can view a full list of inflation-adjusted amounts for tax year 2023 on our website or by searching on our website using the keyword inflation adjustments. Taxpayers who make quarterly payments of estimated tax should use the following rate schedule to determine their payments, which are due starting in April 2023.

The adjustment does not change the Minnesota tax rate that applies to each income bracket. The married separate brackets are half the married joint amount after adjusting for inflation. Chained Consumer Price Index for all urban consumers. The brackets are adjusted annually by an inflation factor, rounded to the nearest $10, based on the change in the U.S. Indexing for inflation of individual income tax brackets is required by law and first began in 1979. This annual adjustment will prevent taxpayers from paying taxes at a higher rate solely because of inflationary changes in their income. For tax year 2023, the state’s individual income tax brackets will change by 7.081 percent from tax year 2022. The Minnesota Department of Revenue announced the adjusted 2023 individual income tax brackets.

0 kommentar(er)

0 kommentar(er)